27+ new reverse mortgage rules

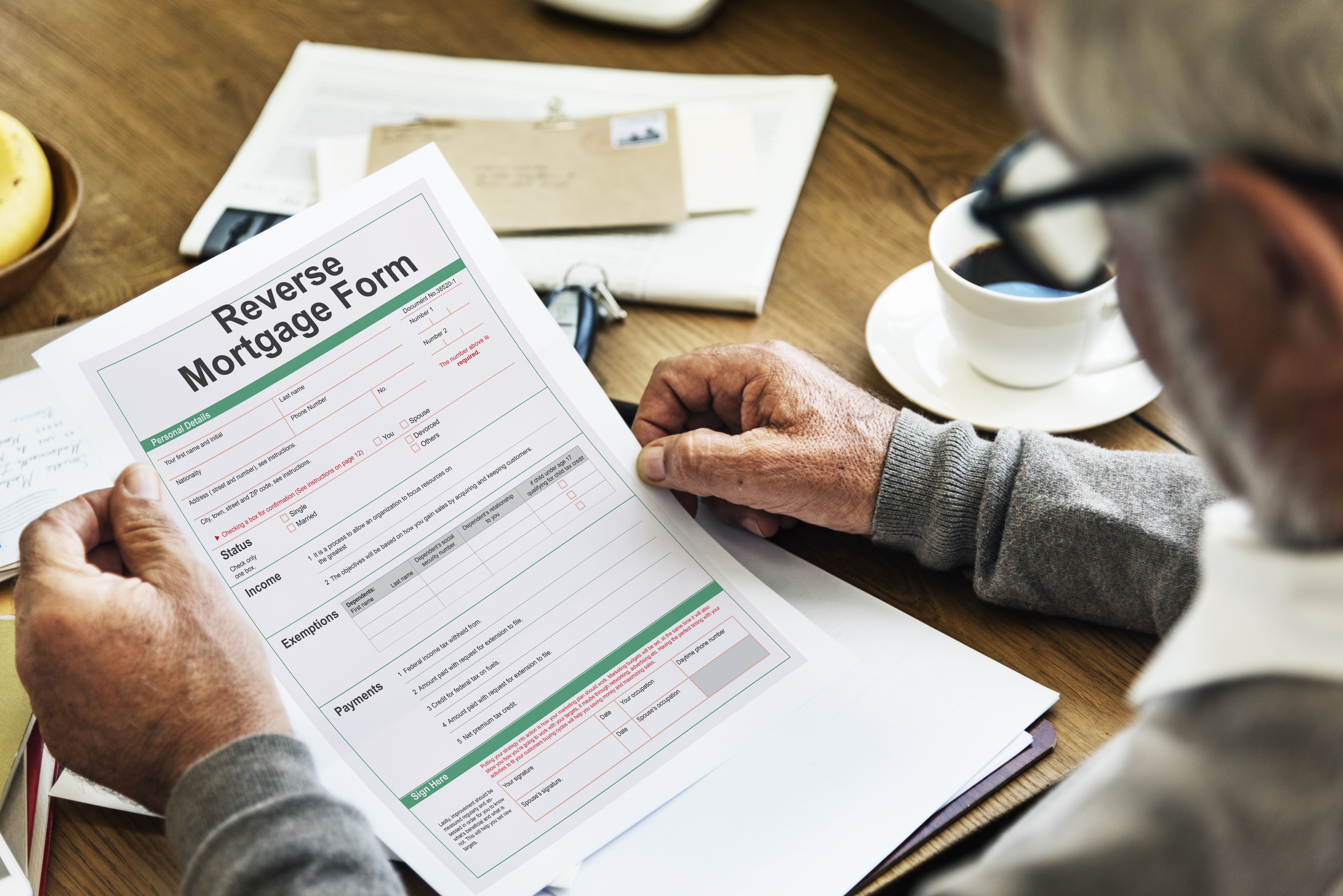

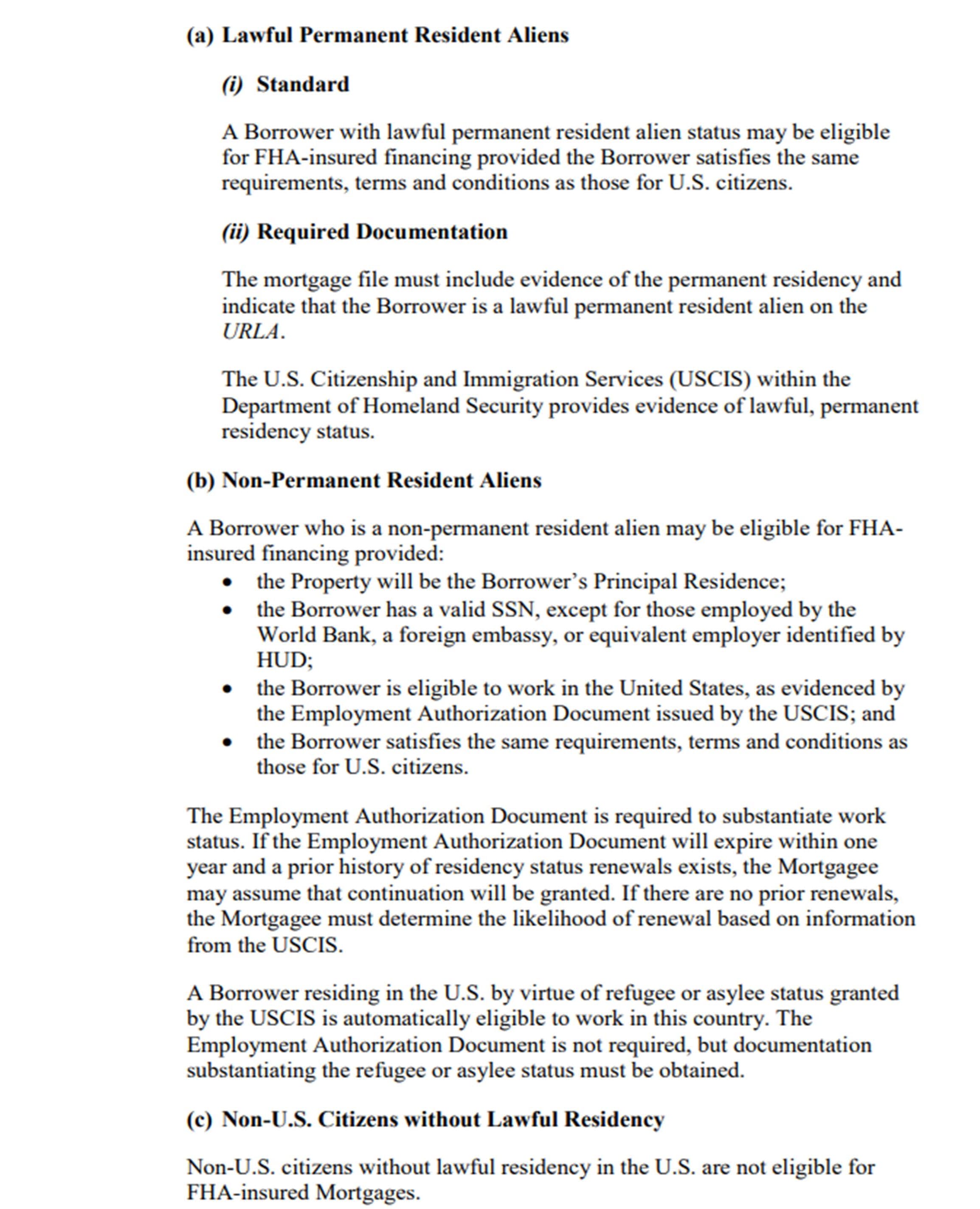

Web As things stand now federal rules allow mortgage companies to evict widows and widowers whose names dont appear on reverse mortgages issued under the Home. Web Generally a reverse mortgage allows a homeowner to obtain a loan using the equity in the individuals home.

Cmp 13 07 By Key Media Issuu

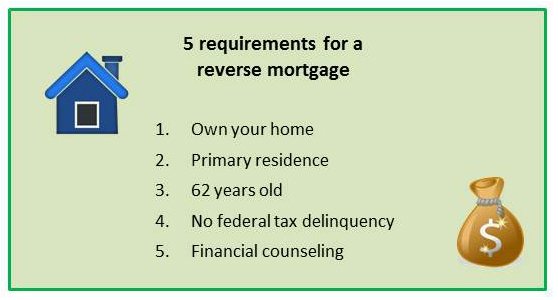

102633 Requirements for reverse mortgages.

. Web Two of the biggest reverse mortgage rule changes have occurred in the last 2-12 years. Are 62 years of age or older. Web A reverse mortgage can limit your options down the road.

All you have to do is keep paying the regular costs like taxes and. Web The Consumer Financial Protection Bureau CFPB on Tuesday announced the publication of a newly-updated resource guide for consumers about the reverse. 102632 Requirements for high-cost mortgages.

Web The borrower must pay an initial one-time premium for the FHA insurance equal to 2 of the loan amount. Occupy the property as a principal. Web A reverse mortgage lets you stay in your current home.

2 will get a lesser amount of money than before and New rules for reverse mortgages. After that the premium is 05 of the outstanding loan. While age requirements vary by loan program all reverse mortgage borrowers must meet an age requirement.

Web 102631 General rules. April 2015 saw the introduction of Financial Assessment and October 2017 saw another. Web The other change expected on Thursday is a lower interest rate charged on the sums borrowed.

Generally a reverse mortgage must be paid back when you die or move from the home. The lender cannot force you to sell or leave your property. Web In December 2021 Governor Kathy Hochul signed a bill allowing New Yorkers age 70 and older to take out reverse mortgages on their co-op apartments.

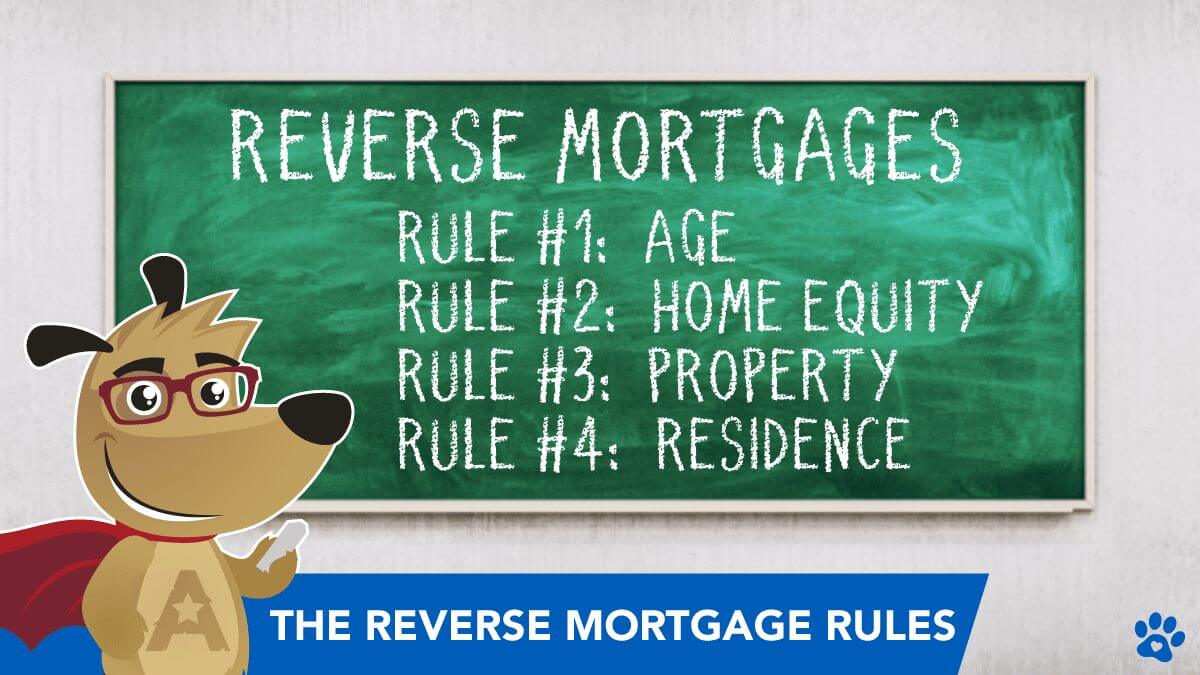

Web Many consumers getting reverse mortgages after Oct. Web To be eligible for a reverse mortgage you must be. Web The new rules apply to the Home Equity Conversion Mortgage HECM program which is the primary reverse mortgage program representing approximately.

Web Whos Eligible for a Reverse Mortgage. On your reverse mortgage application you must include all the individuals listed on your. A person is eligible to take out a reverse mortgage if.

At least 55 years old. Web Although the FHAs rules and regulations for the reverse mortgage loan may seem stringent to some they are designed with the borrowers best interests in mind and are truly. For Home Equity Conversion Mortgage loans.

102634 Prohibited acts or practices in. Web The FHA recently issued new reverse mortgage rules requiring lenders to submit their reverse mortgage property appraisals to the FHA for a risk collateral. Reverse mortgage s allow.

You could use up your. In January 2020 the rate was cut from 525 to 45 in. Reverse mortgages are only available for homeowners who.

What Is A Reverse Mortgage Reverse Mortgage Requirements

Reverse Merger Why Do Company S Do Reverse Merger

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch

What Is The Maximum Claim Amount For A Reverse Mortgage

5 Rules That Apply To Reverse Mortgages In 2023

Lutz News Lutz Odessa March 27 2019 By Lakerlutznews Issuu

Reverse Mortgage Net

The New Reverse Mortgage

This New Type Of Reverse Mortgage Would Help Retirees Generate Much More Income Marketwatch

New Reverse Mortgage Rules Better Or Worse

The New Reverse Mortgage

What Is A Reverse Mortgage Explaining What A Hecm Is

2020 Reverse Mortgage Changes New Limits New Programs

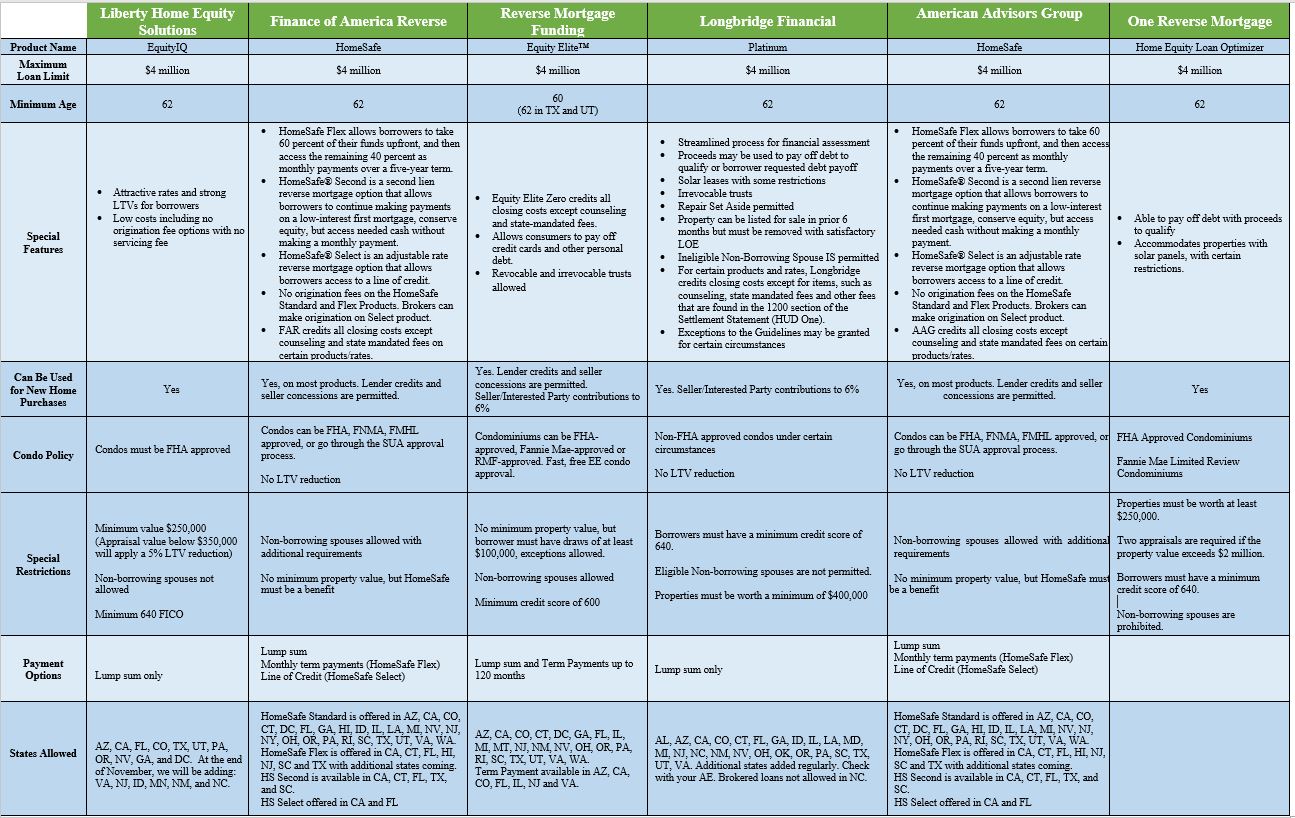

Private Reverse Mortgage Comparison Chart Nrmla

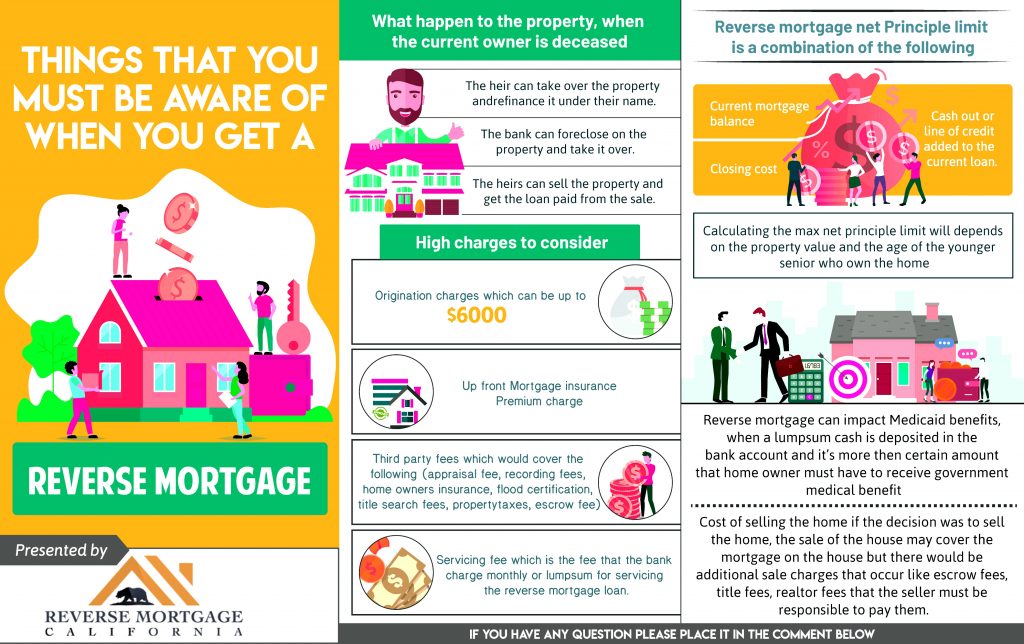

Reverse Mortgage Rules Reverse Mortgage California

5 Rules That Apply To Reverse Mortgages In 2023

Are Reverse Mortgages As Bad As They Say Arrest Your Debt