33+ paycheck tax calculator kentucky

Web To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. After a few seconds you will be provided with.

Annual Report 2003 2004

Ad Compare This Years Top 5 Free Payroll Software.

. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Both the sales and property taxes are. Get Started Today with 1 Month Free.

The process is simple. Track Everything In One Place. Free Unbiased Reviews Top Picks.

The Kentucky minimum wage is 725 per hour. Ad Manage All Your Business Expenses In One Place With QuickBooks. Explore The 1 Accounting Software For Small Businesses.

This amount is known as the wage base and it can change. Web DOR has created a withholding tax calculator to assist employers in computing the correct amount of Kentucky withholding tax for employees. Explore The 1 Accounting Software For Small Businesses.

Web Kentucky Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and. Our Tax Pros Have an Average Of 10 Years Experience. Web Employers pay Kentuckys unemployment insurance on the first 10800 of each workers pay each year.

Web How do I use the Kentucky paycheck calculator. All you have to do is enter each employees wage and W. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week.

Get Your Max Refund Guaranteed. Web Kentucky Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Kentucky you will be taxed 11493. Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent.

Web Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1382 annually. Enter your info to see your take home pay. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Track Everything In One Place. Web We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. Ad Compare This Years Top 5 Free Payroll Software.

Web Kentucky tax year starts from July 01 the year before to June 30 the current year. Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status. Free Unbiased Reviews Top Picks.

Web SmartAssets Kentucky paycheck calculator shows your hourly and salary income after federal state and local taxes. The calculator was developed in a. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

Get Your Quote Today with SurePayroll. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Ad Dont Leave Money On The Table with HR Block.

Web Salary Paycheck Calculator. Web What is the income tax rate in Kentucky.

Academic Catalog By Bluefield College Issuu

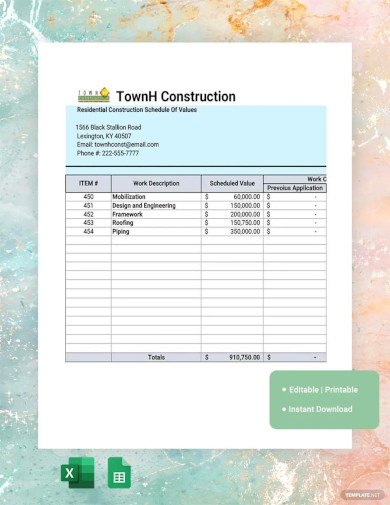

46 Sample Construction Schedules In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages

Kentucky Paycheck Calculator Tax Year 2023

Cda Journal October 2020 Dentistry And Covid 19 By California Dental Association Issuu

New Tax Law Take Home Pay Calculator For 75 000 Salary

Free 10 Notice Of Assessment Samples In Pdf Doc

Kentucky Income Tax Calculator Smartasset

Kentucky Salary Calculator 2023 Icalculator

33 Amazing Job Titles In Slovenian Ling App

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Annual Report 2003 2004

October 2022 Component Manufacturing Advertiser Magazine By Component Manufacturing Advertiser Issuu

Annual Report 2003 2004

Kentucky Paycheck Calculator Tax Year 2023

X1 C80143x1x1 Jpg

Lawrence Journal World 09 02 11 By Lawrence Journal World Issuu

Academic Information Jamestown Community College